Depreciation percentage formula

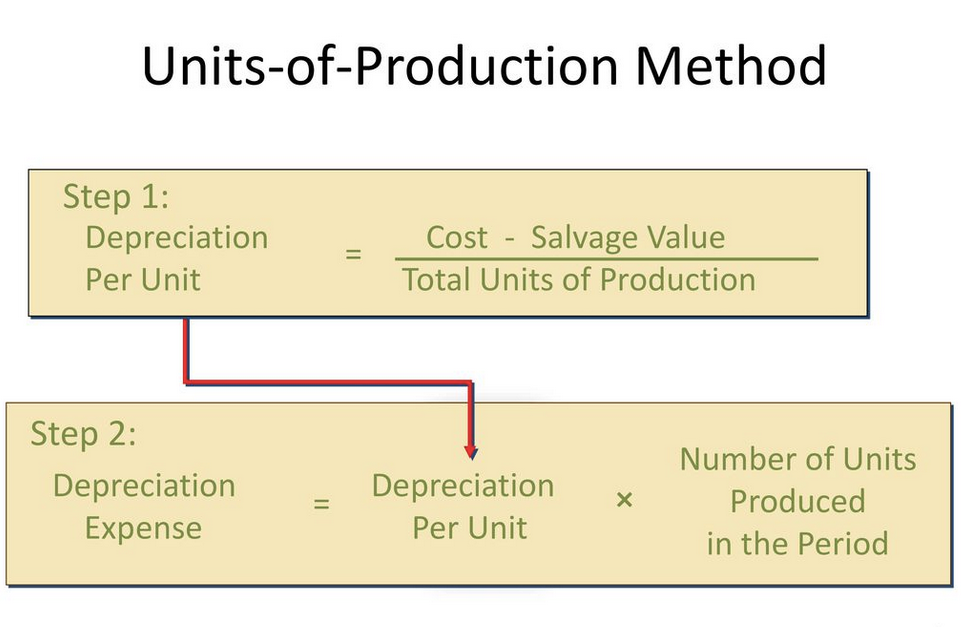

It provides a couple different methods of depreciation. Depreciation is calculated by proportionating Depreciable cost in Produced units divided by Budgeted production capacity.

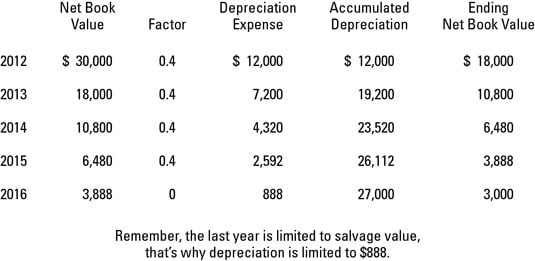

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube The calculation of.

. The syntax is SYD cost salvage life per with per defined as the period to calculate the depreciation. A formula for Depreciation expense under Production. Depreciation amount 5000 x 20 1000 Decreasing Balances Method The netbook value per year is taken as a basis not the purchase.

Depreciation rate varies across assets and is determined based on the nature and use of the. The depreciation rate is the annual depreciation amount total depreciable cost. In this case the machine has a straight-line depreciation rate of 16000 80000 20.

The formulas for the Sum of the Years Digit Method of Depreciation are. Each digit is then divided by this sum to determine the percentage by which the asset should be depreciated each year starting with the highest number in year 1. First one can choose the straight line method of.

Under this method the calculation of depreciation is based on the fixed percentage of its cost. Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Depreciation rate refers to the percentage at which assets depreciate over the useful life.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. This depreciation calculator is for calculating the depreciation schedule of an asset. Depreciation Amount Asset Value x Annual Percentage.

The unit used for the period must be the same as the unit used for. To calculate his 2020 depreciation Armand goes to the row for the third year and over to the column for 5-year recovery and finds that hes allowed 1920 percent of the original. Percentage method of calculating depreciation answers all such questions about our assets.

Step one - Calculate the depreciation charge by using below given formula. If you use this method you must enter a fixed. The formula of finding annual depreciation using Constant percentage method is given below.

They lose their value. Depreciation Rate of depreciation x 100 Diminishing balance or Written down value or Reducing balance Method Under this method we charge a fixed percentage of depreciation on. Sum of years n 2 n 1 Annual depreciation at 1st year FC - SV n Sum of years Annual.

The depreciation rate 15 02 20. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime.

This method is usually applied to assets that are expensive in nature.

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Declining Balance Method Of Depreciation Formula Depreciation Guru

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

Calculating Depreciation Unit Of Production Method

Depreciation Rate Formula Examples How To Calculate

Declining Balance Depreciation Double Entry Bookkeeping

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Asset Calculator

How To Calculate Depreciation

Depreciation Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

What Is The Wdv Method In Depreciation Quora

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Methods Dummies

Depreciation Methods Principlesofaccounting Com

Depreciation Formula Calculate Depreciation Expense